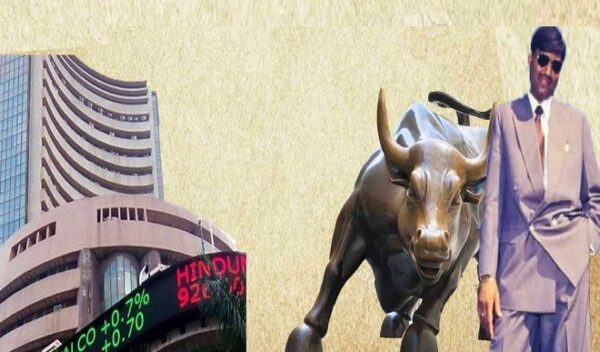

In the world of finance, certain names echo through history, leaving a lasting impact that transcends time. One such name is Harshad Mehta, an enigmatic figure who orchestrated one of the most spectacular bull runs in the Indian stock market. This article delves into the fascinating story of the rajkotupdates.news harshad mehta bull run and provides updates and news related to Rajkot, where Mehta’s influence was prominently felt.

Introduction

The financial world has its share of legends and controversies, and the story of Harshad Mehta encompasses both. In the late 1980s and early 1990s, Mehta became a household name for orchestrating a bull run that shook the Indian stock market to its core. This article explores his life, the events leading to the bull run, its aftermath, and its impact on Rajkot, a city that was deeply connected to Mehta’s activities.

Who Was Harshad Mehta?

Harshad Mehta, often referred to as the “Big Bull,” was a stockbroker and a familiar face on Dalal Street in Mumbai. Born in 1954, he rose from humble beginnings to become a prominent figure in India’s financial landscape. Mehta was known for his charisma, sharp wit, and ability to manipulate the stock market.

The Rise of the Bull Run

The Harshad Mehta bull run was characterized by a surge in stock prices, primarily driven by large-scale manipulation of the banking system. Mehta exploited loopholes in the banking system to siphon off funds from banks and invested them in the stock market, leading to a meteoric rise in stock prices.

The Stock Market Boom

During the bull run, the stock market witnessed unprecedented growth. Stocks of various companies soared to dizzying heights, attracting investors from all walks of life. Mehta’s influence was so immense that he was considered a stock market wizard.

The Scandal Unfolds

The bubble eventually burst, leading to a financial scandal of epic proportions. The irregularities in the banking system and the stock market manipulation came to light, and Harshad Mehta found himself at the center of a massive controversy.

Legal Battles and Consequences

Mehta’s downfall was swift and dramatic. He faced legal battles, including charges of fraud and cheating. The Securities and Exchange Board of India (SEBI) imposed heavy fines and banned him from trading. The aftermath of the scandal sent shockwaves through the financial sector.

Rajkot’s Connection to the Scandal

Rajkot, a bustling city in Gujarat, had a significant connection to the Harshad Mehta scandal. Many investors from Rajkot were drawn into the stock market frenzy during the bull run. As Mehta’s influence spread, the city became a hub for stock market activities.

Recent Developments in Rajkot

In recent years, Rajkot has witnessed a transformation in its economic landscape. The city has diversified its economy and focused on sectors beyond finance. This strategic shift has helped Rajkot recover from the impact of the bull run and strengthen its economic foundations.

Impact on Rajkot’s Economy

The Harshad Mehta bull run left a mark on Rajkot’s economy, but the city’s resilience and adaptability have been remarkable. Today, Rajkot stands as a testament to how a city can bounce back from a financial shock and emerge stronger than ever.

Lessons from Harshad Mehta’s Story

The Harshad Mehta saga serves as a cautionary tale for investors and regulators alike. It underscores the importance of transparency, accountability, and robust regulatory mechanisms in financial markets. Mehta’s story also highlights the need for investor education to prevent such manipulations in the future.

Conclusion

The Harshad Mehta bull run remains an indelible chapter in India’s financial history. While the legend of the “Big Bull” lives on, it is essential to learn from the past and ensure that the mistakes of the past are not repeated. Rajkot, with its resilience, has shown that even in the face of adversity, a city can thrive and grow.

Frequently Asked Questions

- What led to the Harshad Mehta bull run?

The bull run was driven by large-scale manipulation of the banking system and stock market by Harshad Mehta.

- What were the consequences of the bull run?

Harshad Mehta faced legal battles, fines, and a ban from trading. The stock market also witnessed a crash.

- How was Rajkot connected to the scandal?

Rajkot had many investors who participated in the bull run, making it a significant hub for stock market activities.

- How has Rajkot’s economy recovered?

Rajkot has diversified its economy and focused on other sectors, which has helped it recover and grow.

- What lessons can we learn from Harshad Mehta’s story?

Transparency, accountability, and investor education are crucial in preventing financial manipulations like the Harshad Mehta scandal in the future.